Malaysia Property Trend

Language Option

Property Description

Hanaz Suites is a 45-story tower, located in the middle of Kuala Lumpur City Centre (KLCC), which combines residential and office suites in it. It offers 270 units that are carefully designed to reflect the colors of a spring festival. It also combines classical Japanese design with modern architecture in its building concept.

Contact Agent

Adrian Ng

+6017-6953309

Property Details

Property Type

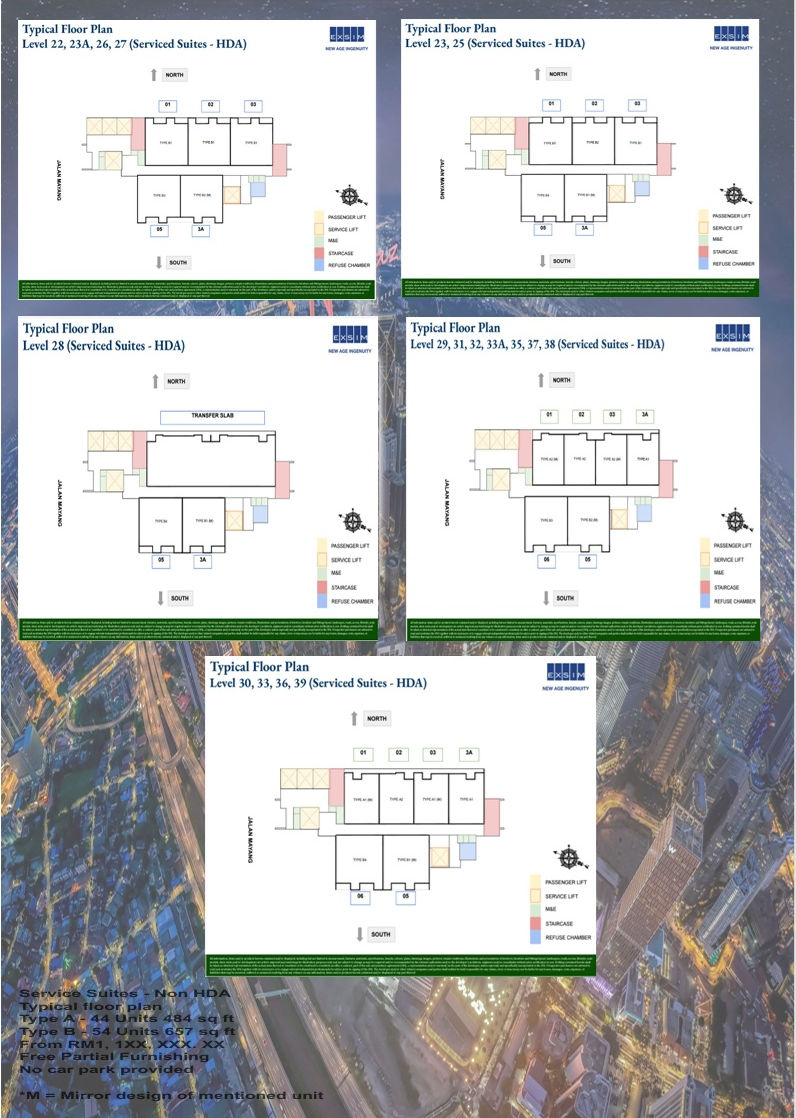

Serviced Suites and Office Tower

Bedrooms

Studio to 2

Bathrooms

0 to 2

Title

Commercial & Commercial with HDA

Size From

323 sqft

Floors

45

Year Completion

Q4 2029 Est

Tenure

Freehold

Property Location

KLCC, Kuala Lumpur City Centre, Kuala Lumpur, Federal Territory of Kuala Lumpur, Malaysia

The following data is extracted from EPIQ, a tool by EdgeProp.my, which analyzes real estate transactions in Malaysia using data from NAPIC. As of March 2025, rental prices around the Hanaz Suites KLCC location range from RM4.70 per sq ft to RM7.68 per sq ft, while sale prices average between RM630.00 per sq ft and RM1,800.00 per sq ft. Hanaz Suites is currently priced between RM77X,XXX.XX and RM1,1XX,XXX.XX, equating to an average of RM2,300 per sq ft, with completion expected in late Q4 2029. This premium pricing reflects its prime location in the heart of Kuala Lumpur, just a stone’s throw away from the iconic Petronas Twin Towers. Given the scarcity of development land in this area, property values are expected to rise, reinforcing Hanaz Suites as a strong investment opportunity.

As a mixed-use development, Hanaz Suites consists of both commercial office units and residential units, with a total of only 172 office units and 98 residential units. This limited supply enhances its exclusivity and desirability. For comparison, Star Residence—one of the closest similar properties, has transacted at around RM1,800 per sq ft. Given this, Hanaz Suites' RM2,300 per sq ft entry point for a freehold, centrally located property due for completion in 2029 may be justifiable, particularly for investors seeking long-term capital appreciation.

Disclaimer: The insights provided are based on the Editor's personal knowledge and experience in the real estate industry and should be treated as a reference, not financial advice.